*This post may contain affiliate links, please see my disclosure

You Need A Budget 4 (YNAB) is a full version software only available for Windows, that belongs to the category Games and has been created by YouNeedABudget.com. More about You Need A Budget 4 (YNAB. The downside of YNAB is the cost. Mint and Personal Capital are free, but YNAB is $6.99 a month, billed annually at $83.99. The service typically offers a free trial for a month or two. How to Apply YNAB’s Method for Free With Google Sheets. Even after my initial success with YNAB, I’m no longer using the service. Bank2OFX is an useful utility to convert QIF, OFX, QFX, QBO, OFC files to the OFX format. Open your bank file in format you have and convert to OFX format.

YNAB is one of the most popular budgeting apps out there. I have personally used several versions of it over the past decade, and currently track our budget with YNAB even today!

If you search on Reddit or other popular money forums, you will see overwhelmingly positive reviews, and lots of fans that adore everything about YNAB.

But it’s not for everyone. And instead of simply NOT budgeting your money because it doesn’t work for you, I wanted to show you a few of the best alternatives to YNAB.

I specifically looked for apps that are easy to use and are CHEAPER than YNAB, some of them are even FREE!

So, if you aren’t on the YNAB bandwagon, check below for some of my favorite YNAB alternatives!

Why YNAB May Not Be for You

It Costs Too Much. YNAB used to be a one-time cost tool, and has since moved to a cloud-based model. This means lots of great feature updates, but also, it’s now a monthly (or yearly) recurring cost. The price increase, and recurring cost might be a deal-breaker for some. Currently YNAB is $84/yr. (averaging $7 per month).

Complicated Setup. YNAB can feel overwhelming if you are brand new to budgeting. And then managing things like Credit Cards and setting up recurring transactions, can feel a little…..advanced. I’ve heard from users that they simply gave up after a few months because they couldn’t keep up with how YNAB was designed to work.

No Investing Tools. YNAB can do most anything with budgeting, but they simply are not designed to help you with investing. There are no tools to show you how to invest, project your retirement savings, or anything.

Poor Reporting. One of my personal issues with YNAB is their reporting is too simplistic, especially on the mobile app. They have added a few reports

YNAB Alternative Apps: What To Look For

Free (or at least Cheaper). There are many Free budgeting apps available (though not all of the are good). There are also cheaper apps with lots of functionality. So, when searching for an alternative to YNAB, I wanted to highlight a few options that cost less, and still pack in some great features.

Simple To Use. If your budget isn’t simple, then users won’t care how amazing it is. With YNAB, I personally like the details of it, but for some, it’s simply too complicated. I wanted to highlight a few options that are “easier” to use than YNAB (though I’ll admit, ease of use can be in the eye of the beholder).

Help With More Than Just Budgeting. YNAB is a true budgeting app, through-and-through. But some users want MORE, so I also am highlighting a few apps that bring more than just budgeting in terms of features. Things like investment tracking, total net worth tracking, and investing education and advice.

The 5 Best YNAB Alternatives

There are dozens of money apps out there, so I wanted to just show the ones that I think bring good value as an alternative to YNAB. Some of these are free, most are cheaper, and they bring lots of

My Free Budget Template (Google Sheets)

My budget first started in 2008 on a simple excel spreadsheet. Over a decade later, it has evolved, but I still like to keep it clean and simple.

I created the Google Sheets budget template for a few reasons.

- Sync With Your Partner. I wanted a way for people to be able to sync their budget with their spouse or partner. Google Sheets allows you to simply share the sheet with anyone by email address. They can then simply click the link and it will open up and been in sync with the other person.

- I wanted it to be mobile-friendly. I sized it to fit on a mobile device, because the hardest part of budgeting is simply tracking your expenses and categorizing them. Having it with you makes it VERY EASY to pop in each transaction once you make the purchase.

You can grab your own copy for FREE below!

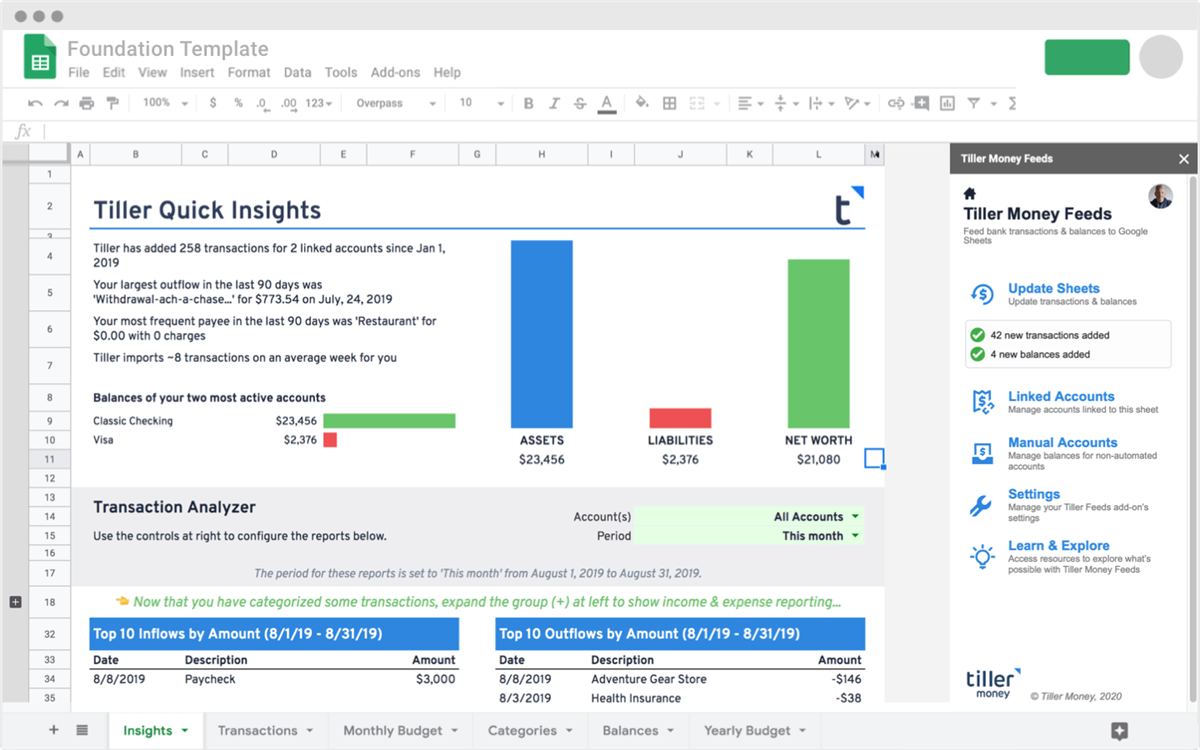

Tiller Money

Tiller Money is a tool that allows you to sync your bank accounts to a Google Sheets or Excel Spreadsheet budget. You can use one of their templates, or create your own.

Their connector then syncs your financial accounts, and for Google Sheets users specifically, you can set rules to automatically categorize your transactions as well.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21995190/Screen_Shot_2020_10_28_at_10.07.43_AM.png)

It also has a support community, weekly LIVE webinars for financial education, and a daily email summary of your transactions.

If you want total control of your money, custom to your exact situation, spreadsheets are still the best way to do this. And Tiller has found a way to POWER UP your spreadsheet by making it automatic.

If you want more control than YNAB gives you, and you want to spend (slightly) less money (Tiller is less than $7/mo), then learn more about Tiller HERE.

BONUS: Tiller has a way to import your YNAB budget!

Personal Capital

Ynab Download 4

Personal Capital is a FREE financial tool which is focused on investment tracking and education, but also has the ability to sync your financial accounts and track your spending.

Personal Capital’s spending tracker and reporting are fairly basic, but give you a quick snapshot of your money. It’s not a budgeting software in the traditional sense (you can only set a total monthly budget, but not budgets for each category), but for those who want to step back from the day-to-day of budgeting, it will help you still keep an eye on your spending.

Personal Capital shines in its investment tools. It’s “Fee Analyzer” gives you a great way to see how fees can affect your retirement (hint: they can hurt a LOT). And the “Retirement Planner” shows your projected investments and what you can spend per month in retirement.

For those who want more tools, charts and graphs, and want to get a bigger financial picture outside of the monthly budget, Personal Capital can be a great tool.

Personally, I use Personal Capital to track my net worth and analyze my investment strategy for retirement, and I use a separate budget for the daily tasks.

If you want to try out Personal Capital for FREE, learn more about them HERE

Mint

Mint.com is a FREE money management tool that helps you create a budget, track your spending, track your bills, set money goals and see a full snapshot of your finances. It is owned by Intuit, the same company that brought you Quicken and TurboTax. It is ad-supported, so there is no monthly cost to use it.

It has some good budgeting tools built in, including goal-setting and some nice visual graphs to see how you are doing with your spending. It also has some basic reporting and tracking of your investment accounts.

It a great tool to get started with your budget, because it pulls in your previous spending for the past few months, and categorizes it for you too. The setup is more automatic than YNAB, and it’s pretty simple to get started.

If you want to learn more about Mint.com, see my full review and how to use it HERE

Ynab Classic Android

EveryDollar

EveryDollar Dave Ramsey’s brain-child for his budgeting system based on the 7 Baby Steps. It’s a straight-forward budgeting app, that allows you to give “Every Dollar” an assignment. It also incorporates his 7 Baby Steps into the app, allowing you to track your Financial Progress, which is kind of cool!

It’s pretty straight-forward to get started, and they have a VERY simple step-by-step process for inputting your income and expenses into the budget. I would say it’s probably the easiest setup for any budgeting app.

There are two versions of the App, the FREE version (which is full budget, just need to manually enter your transactions), and the “PLUS” version, which includes syncing with your financial accounts, custom reporting, access to Financial Peace video content, and built in baby-steps tracking.

It’s a great alternative to YNAB for people who want a simple setup process, and want to get started in 10 minutes or less.

You can manually track using the FREE version, or sync your accounts (and access other features) for $129.99 per year.

Final Thoughts

Ynab Classic Apk

YNAB is a great budgeting tool, but there are some great options besides YNAB to help you get your money right!

I recommend trying out at least one of these options to see if it fits your budgeting style, and stay on top of your finances.

Ultimately, these are only tools, but they don’t replace you as the CFO of your life. Grab an app, take back control of your money, and start your journey to Financial Freedom today!

Related posts:

If you're looking for an alternative to You Need a Budget (YNAB), you're in the right place. I’ve been closely following YNAB as it’s evolved over the last few years. I remember YNAB4 when it was a software application you purchased. I remember when it transitions to a monthly service. I remember how upset people were but I felt from a business perspective, it made them better suited to invest in the business to make it even better.

There are several reasons why you might be looking to replace YNAB. The best alternative for you will depend on why you're replacing it. Whether it was the recent price increase, outgrew the product, or you feel like you could do it on your own?

With plenty of options we breakdown the top 5 YNAB alternatives below.

Why Do You Want to Switch?

The YNAB Price Increase – YNAB used to be $50 a year, billed annually. It will now be $6.99 a month, still billed annually so $83.88. It's a sizable percentage increase but not a significant dollar increase, just under $3 a month.

I think it's worth $3 a month for YNAB but long-time users have had to navigate two pricing changes the last few years – first, when the software went from a flat fee to a monthly fee; now, to a slightly higher monthly fee.

To put it into perspective, EveryDollar is a budgeting app that has a free component but costs $129.99 a year for their Ramsey Plus (they rebranded it and added features to what was previously EveryDollar Plus).

It follows Dave Ramsey's Total Money Makeover approach, has a similar “give every dollar a name” philosophy, and is on a freemium model. That means the app is free but if you want to connect financial accounts, download data automatically, that'll run you $129 a year. It's still cheaper than one of their most similar alternatives (which we don't list below because it's more expensive).

You've Graduated – Congratulations! YNAB has put many people on the path to sound budgeting with its “Every Dollar Needs a Job” mentality. If you're ready to graduate to a free tool without as much guidance, then there are several options below.

If you need less guidance and you want more support in the area of investing and retirement planning, my best recommendation is Personal Capital. It offers a personal finance dashboard that lets you plan for your investments and retirement better than any of the alternatives.

If you need less guidance and just want to track your budget, my best recommendation is Mint. Track your budget automatically, completely free, but you don't get the same philosophy and guidance as YNAB. We compare YNAB vs. Mint in a head to head comparison that you can use to decide if mint is the one for you.

What We Looked For

You chose You Need a Budget for a specific reason and it's not just to “track your budget.” There are a ton of budgeting apps out there and most of them are free.

You chose YNAB because of the philosophy and how the tools married with those philosophies. You wanted more than a simple tracker tool.

We also didn't include alternatives like EveryDollar (until the end) because they were more expensive. We recognize YNAB is pretty solid on features so you're probably looking for a cheaper replacement rather than a more expensive one. (if we're wrong, let us know!)

1. Tiller

What is Tiller?Tiller is an automation tool that integrates with Google Sheets so you can build your own budgeting spreadsheet while pulling in data automatically from your accounts.

Why is Tiller a good YNAB alternative? First and foremost, they have a way to import your YNAB budget into a Google Sheet. So if you wanted to make the transition, it's super easy.

Second, and this is more about spreadsheets than about Tiller specifically, but you get complete control and customization with Tiller powering your spreadsheet. You tailor the spreadsheet to exactly what you want and they pull in the data so you avoid the manual data entry. I use a spreadsheet for this very reason.

Tiller is just $79/year after a 30 day trial, which makes it slightly cheaper than YNAB. If you start using it and are able to save more money in your budget, those savings could easily pay for Tiller. Read our Tiller review for a deep look at what makes this tool so great.

2. Personal Capital

What is Personal Capital? Personal Capital is a personal finance dashboard that will aggregate all of your accounts in one place. They have a premium financial advisory service as well as wealth management, but those are optional (I don't use them). There are also powerful planning tools, like planning future income in retirement based on your expenses, that really make it a 30,000 foot view other tools don't even try to do.

Why is it a good YNAB alternative? It's not a good budgeting tool replacement for YNAB but if you want to graduate from just budgeting to higher-level financial management, Personal Capital can be a helpful tool. I don't mean “higher level” as in “better” or “superior,” I mean 30,000-foot view vs. 10,000-foot view.

Budgeting is crucial but it has a short-term view. You may budget your paycheck, which may be weekly, bi-weekly, or monthly. You may budget annually too – but you won't be budgeting from now until your retirement. That's why a tool like Personal Capital can be valuable – giving you visibility on the long term view.

Personal Capital is free.

3. Mint

What is Mint? Mint is one of the oldest budget tracking packages out there and they are owned my Mint, who were the former owners of Quicken. Mint has everything you need in a budgeting app and is completely free. Many of the budgeting tools may sound familiar to YNAB but they will take getting used to it. You have bill pay functionality as well plus additional features like credit monitoring and some investing tracking (but no recommendations or advice).

Why is it a good YNAB alternative? If you need a budget but don't want to pay for You Need a Budget, this one gets you all the budgeting functionality at absolutely no cost.

Mint.com is free.

4. CountAbout

CountAbout was designed specifically to be an alternative to Quicken, which is one of the oldest and most popular budgeting packages out there. CountAbout was founded in 2012 and offers a very rich feature-set at a very modest price. It costs just $9.99 for the Basic and $39.99 for Premium (which includes automatic transaction download).

Here are some of the other key features, making it a solid budgeting tool without the monthly fee:

- Imports data from Quicken and Mint

- 12,500+ financial institutions

- Multi-factor login protection

- Android and iOS apps

- Category customization (add, delete, rename)

- Tags (add, delete, rename)

- Reporting for Account balances

- Reporting for Category activity

- Reporting for Tag activity

- Report exporting

- Individual Account QIF importing

- Budgeting

- Running register balances

- Account reconciliation

- Graphs for Income & Spending

- Recurring transactions

- Investment balances by Institution

- Memorized transactions

- Split transactions

- Description renaming

5. EveryDollar

EveryDollar is a very basic budgeting tool created by the team behind Dave Ramsey, using his principles for managing money. We reviewed EveryDollar and found that it's claim of being able to set up a budget in 10 minutes to be accurate – it's super simple, very easy to navigate, and follows the overall structure of Dave Ramsey's Baby Steps.

It is a freemium product with the free version letting you do everything the budgeting tool offers. There is an EveryDollar Plus (now part of Ramsey Plus) that's $129.99 per year which adds in automatic transaction downloads and a few other features. With the Free version, you have to manually enter all of your transactions.

Conclusion

If You Need a Budget has served you well, my recommendation is to find a few bucks each month to continue paying for it. No tool offers what it does at a cheaper price and there's a reason why it's one of the most popular personal finance tools out there – it works.

One of the nice things about many of the recommendations on this list is that they have trials or are completely free. Keep with YNAB, try one of the alternatives we listed, and if it wins – switch. If it doesn't, you won't have lost a step with your existing budget.